Bringing Pests, Invasive Species and Biological Risks under control

A $423B problem that’s accelerating in our changing world

Not all climate risks are floods and fires

We’re passionate about building a portfolio of pre-seed/seed companies leveraging technology to support their customers detect and remediate these PIB risks that are escalating like never before…

UpRoot is a VC Fund formed to bring Pests, Invasive Species and Biological (PIB) risks under control.

Why the focus on PIB risk?

A calamitous cocktail of changes in land use, globalisation, increased resistances, and a warming world have catalysed PIB risks to grow by 702% over recent decades. We need to UpRoot these risks now before it becomes any worse….

Pests

Endemic species like the locust have populations that are exploding

Invasive Species

Non native species breaching terrestrial and aquatic geographical barriers, like the Sea Lamprey which has infested the Great Lakes and decimated fisheries

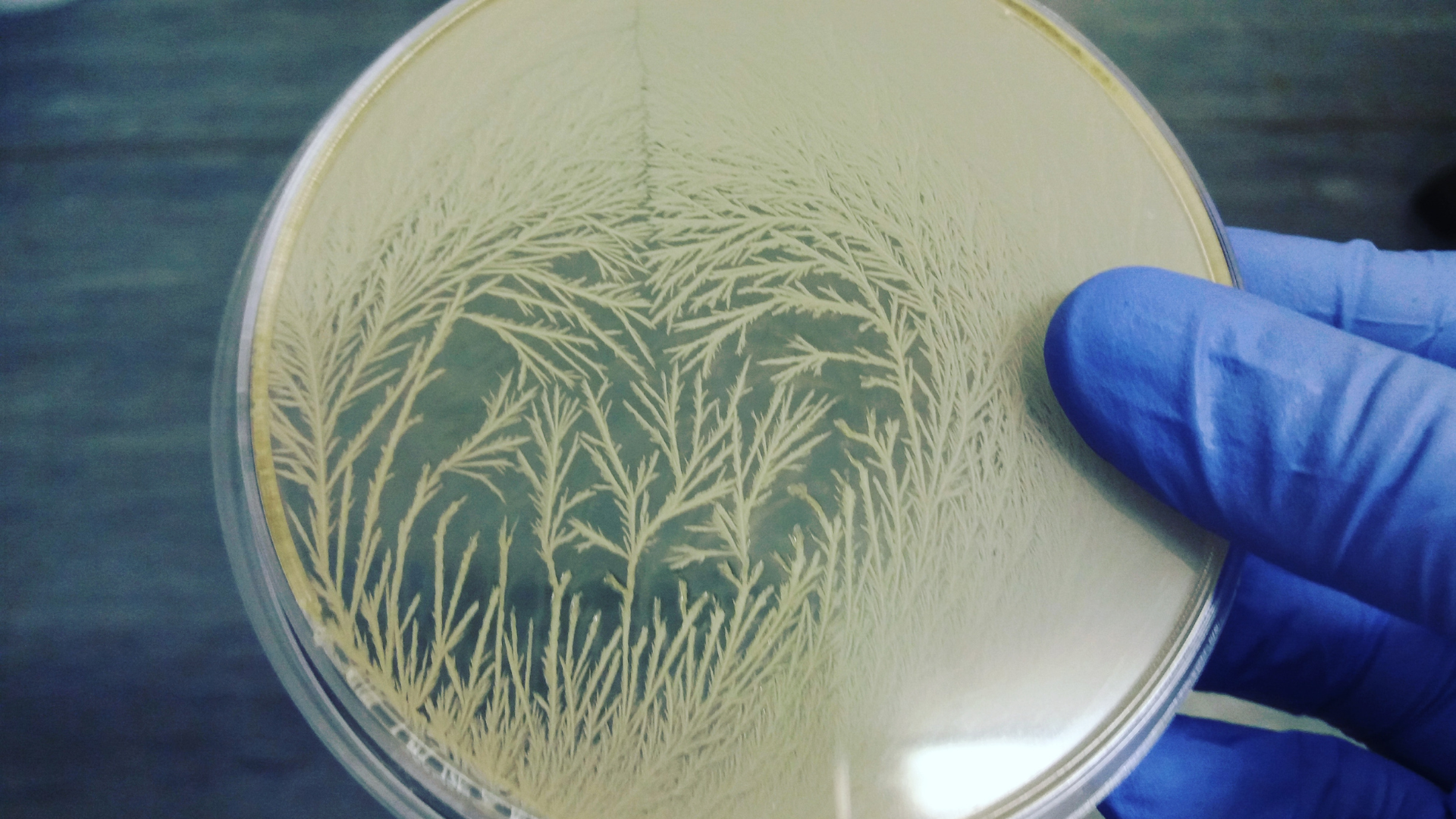

Biological Risks

Direct threats to human and ecosystem health. Vector-borne diseases like Lyme from expanding tick populations, waterborne pathogens including harmful algal blooms, and fungal threats devastating crops and forests.

Sector focus

Our portfolio companies will service six key sectors facing escalating PIB Risk:

Agribusiness

Industry & Infrastructure

Conservation

Public Health & Safety

Hospitality & Tourism

Transport & Logistics

Angel Syndicate

We don’t want to miss the incredible founders already building solutions for PIB risks, therefore, we’ve built the first angel syndicate to exclusively back early stage companies tackling this realm.

We’re investing alongside industry veterans in better, cheaper and faster solutions for escalating biological risks.

Testing our thesis and building a track record before raising a fund in 2026.

Technology Focus

Prediction & Detection

Early identification tools that help customers stay ahead of PIB risks

Control & Remediation

Solutions that help customers control and eliminate PIB risks more effectively

What We Look For

We back companies with validated customer demand, technical differentiation, and clear paths to scale. Founders must be customer-obsessed, understand their market deeply, and navigate regulatory requirements effectively.

Investing in a multifaceted toolbox. Portfolio companies are leveraging a combination of: Robotics, AI, Software, Hardware and Chembio solutions.